Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Market Updates, Inflation & Interest Rates, Happiness Index and More…

| 27th September 2024 |

Australian Market UpdateWe’re at the end of September but its two data points from August that were released in the past week that are the headline news. First, the Reserve Bank of Australia’s (RBA) preferred inflation gauge, “trimmed mean inflation”, rose to 3.4% in August, indicating persistent underlying price pressures. The RBA is expecting this gauge to remain above its target band until late 2025. Second, annual inflation or Consumer Price Index (CPI), was 2.7 per cent in August, down from 3.5 per cent in July, and is the lowest reading since August 2021. Energy rebates and a decline in petrol prices contributed to the lower headline inflation. However, RBA Governor Michele Bullock emphasised the need to focus on underlying inflation and warned against premature expectations of a return to the target band. The RBA has all but ruled out rate cuts before Christmas, citing ongoing inflation concerns. This puts it out of cycle with most other major developed economies. Forecasts suggest that headline inflation will temporarily fall within the target band but then rise again once government support expires. The RBA is now projecting a sustainable return to the target band by December 2025. With an election due by May 2025, the timing of any rate cut has become very politically sensitive. In the past month, the Australian dollar strengthened against several major currencies. It reached its highest level since July 2023 against the US dollar, driven by the RBA monetary policy stance and the US decision to cut rates. The AUD/USD exchange rate reached a high of around 0.6870 in September, representing a significant appreciation from earlier levels. The AUD/EUR exchange rate also strengthened, reaching levels not seen since early 2023 and the AUD/JPY exchange rate saw gains, reflecting the relative strength of the Australian economy compared to Japan. While the ASX200 rose on the inflation news, investor reaction was muted, with the CPI data largely in line with market expectations. Off the back of the reporting season last month the ASX200 started September down by 1.4%, which is almost exactly what the average decline of the past 24 years has been. According to S&P Market Intelligence, September has been the worst month (by far) over the past 24 years, with an average monthly return of negative 1.35%. However, not to be hamstrung by history the market bottomed on the 5th and has pushed ahead to deliver a positive month – at the time of writing. These remain uncertain times for investors as the RBA battles to tame inflation locally whilst there continues to be significant influence from global events. If 2024 has proved anything, it is to remain invested when it feels like bailing out is the answer. |

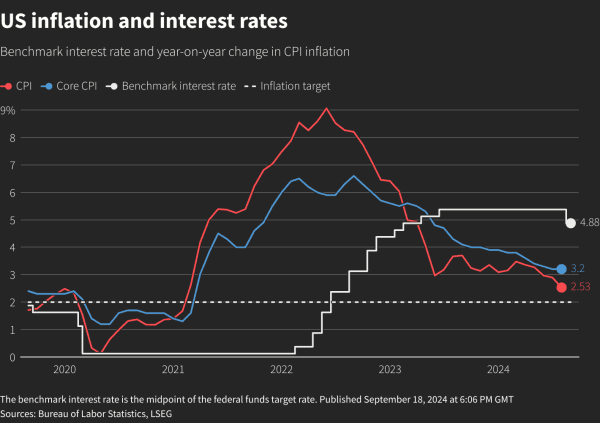

Global Market UpdateFollowing on from US Reserve Bank chief Jerome Powell’s big statement last month that “the time has come for policy to adjust”, the Fed has delivered. It lowered US interest rates by 50 basis points at the September 2024 Federal Open Market Committee meeting, marking the first rate cut in four years. Whilst the cut was forecast, the size wasn’t predicted by many. This decision was aimed at supporting economic growth and stabilising the slowing labor market. The Fed’s rate cut statement acknowledged progress in reducing inflation and emphasised its commitment to achieving maximum employment. However, the statement also noted that risks to the unemployment rate have increased. The median forecast for the unemployment rate was raised to 4.4%. The Summary of Economic Projections (SEP) indicated that the Fed expects to cut rates further in 2024 and 2025. Powell also doubled down on his Jackson Hole comment last month: “The direction of the travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” emphasising that the Fed’s decision on future rate cuts will be data-dependent. Strategists are now predicting there could be two additional rate cuts in 2024. Market reaction to the Fed’s announcement was positive, as evidenced by the continued rise in stocks over the following days. Falling bond yields also suggested that traders are expecting further rate cuts. The People’s Bank of China (PBOC) unveiled a significant stimulus package to boost the economy and combat deflation. The stimulus package was the most aggressive since Covid and included interest rate cuts, increased liquidity, and measures to support the property market. It remains to be seen whether these changes will be enough to get China back on track to achieve its growth targets given weak credit demand and the need for more fiscal stimulus. The property crisis and declining consumer confidence pose additional challenges. The PBOC’s actions led to a rally in Chinese stocks and bonds and a stronger yuan. It has also led to a stock rotation in Australia from Banks to Miners in anticipation of an uptick in demand for our commodities. The European Central Bank (ECB) cut its main interest rate by 0.25 of a percentage point, with the deposit rate lowered from 3.75% to 3.5%. This was the second time the ECB has cut rates since its cycle of rate rises ended in September 2023 (the first cut was in June 2024). Cuts in rates by both the US and China will have the attention of the RBA as they balance their fight against inflation with managing the value of AUD and its impact on our exports. Bank of England’s Monetary Policy Committee (MPC) announced their decision to leave interest rates unchanged at 5.0% following the 0.25% rate cut in August. This was in part led by inflation returning to an acceptable level of 2.2% in August, but still above the 2% target. The actions of the central banks globally are predicted to continue to shape markets at least until Christmas. This will be an ongoing battle of managing growth targets while keeping inflation in check. Markets are reacting well to the actions of the central banks but there is still uncertainty as to whether the actions have been enough or too much. The next moves will be critical in shaping ongoing growth or a slide into a recession. |

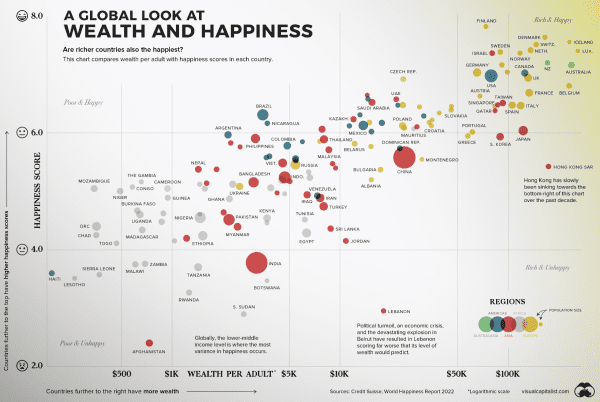

Chart of the MonthThe Complex Relationship Between Money and Well-beingEver wondered if money can truly buy happiness? While the idea of a direct correlation between wealth and happiness is often discussed, the reality is more nuanced. A recent analysis by Visual Capitalist explores this relationship using data from the World Happiness Report and Credit Suisse. The findings reveal a general trend: wealthier nations tend to report higher happiness levels. However, this relationship is not always straightforward. In many cases, there is a clear link between wealth and happiness. Countries with higher average wealth per adult often report higher happiness scores. However, some countries deviate from this trend. For example, several Latin American nations report higher happiness levels than their wealth might suggest, potentially due to strong social connections and cultural factors. Middle Eastern countries, on the other hand, report slightly lower happiness despite their wealth. Nordic countries consistently rank high in happiness surveys and are also some of the highest wealth per adult countries in the world. Denmark, Norway, Sweden, Finland, and Iceland all rank in the top 10 for happiness and the top 20 for wealth even though parts of these countries are dark for most of January!! It’s evident that wealth plays a significant role in national happiness, but it’s not the sole determinant. Factors such as strong social connections, community support, cultural values, and good governance also contribute to well-being. Civil unrest appears to be a major factor for low happiness scores as well as low wealth. Interestingly, the research also notes that once basic needs are met, the correlation tapers off suggesting the very wealthy are no more happy than the “just” wealthy. So, can you buy happiness, but only to a point it would seem? |

|

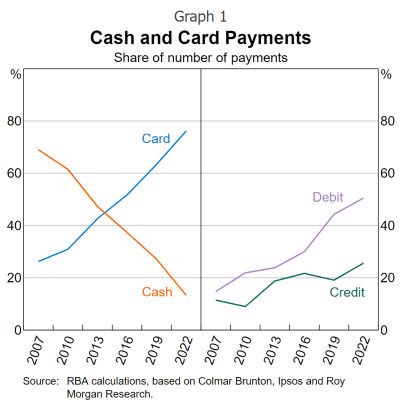

That’s the annual figure Australian financial data company, Canstar, estimates Austalians are paying in credit and debit card fees every time they swipe. It’s a staggering figure, highlighting the often-overlooked fees associated with electronic payments. EFTPOS, or Electronic Funds Transfer at Point of Sale, has become an integral part of Australian daily life. From supermarket shops and petrol to take away coffees, most purchases are now made using cards. The use of cash has fallen from 69% of transactions in 2007 to just 13% in 2022, according to the most recent RBA calculations. However, behind the convenience lies a complex network of fees that ultimately impact consumers’ wallets. Should it be the consumer who pays? Especially given that using cash actually requires more human handling, security and transport costs. And where does the extra money we are paying go? A significant portion is absorbed by banks and financial institutions. They charge merchants a fee for each transaction, and these costs are often passed on to consumers in the form of higher prices. Additionally, card networks such as Visa and Mastercard also impose fees on merchants, which can further contribute to increased costs. A recent stunt by NSW Labor MP Jereome Laxale in a Federal Parliamentary committee highlighted the issue. Laxale held up a well-used $5 polymer banknote. Why, he asked the bosses of Australia’s major banks facing the parliamentary committee, if he paid for a $5 cup of coffee with his credit card did it cost $5.08? However, should his question have been to the major banks or to the cafe that charged him the $0.08? It’s often assumed that cash is a free payment method. According to a report by Boston Consulting Group, accepting cash can actually cost a business up to twice as much as accepting a digital payment thanks to factors such as security measures, staff time, and the risk of theft or fraud. If this is accepted to be the case, then why aren’t we as consumers being offered a discount by a business for paying by card? The other aspect of the payments landscape that is often unrealised is the massive investment by the banks to provide this modern convenience. Gone are the days of being able to access your money from inside a bank branch only on weekdays between 10am and 4pm. Consumers expect to live in a 24/7 world and to facilitate this, banks and card providers have invested billions to establish and maintain the secure systems we have today. There is an argument they are therefore entitled to get a return on this investment by charging us for this convenience. Efforts have been made to address the fee issue with government inquiries and industry discussions. However, finding a balance between supporting businesses and protecting consumers remains a challenge. Some have advocated for a more transparent fee structure, while others have suggested capping certain charges. Independent and small businesses also argue they pay a disproportionately higher amount of fees because large retailers such as chains negotiate better deals. The debate over surcharging in Australia is complex and multifaceted. While businesses incur costs associated with accepting electronic payments, they also benefit from the increased efficiency and security that these payments offer. The RBA, which allowed surcharging to start 20 years ago, is now seeking a solution that balances the interests of banks, card issuers, businesses and consumers. A consultation paper is due for public release by year’s end. |

4 Things to Know About ChinaIn recent years, mostly due to COVID lockdowns, increasing regulatory intervention in the private sector and ongoing geopolitical uncertainty, many foreign investors have redirected their capital away from China towards other emerging markets particularly India. Nevertheless, China remains the world’s second-largest economy with a vast consumer base and a primary trading partner to most other economies. So, any insights into what’s happening there are always welcome. Recently a team of partners from US fund manager Capital Group toured two dozen companies in Shanghai, Beijing, Suzhou and Shenzhen (pictured above), home to China’s leading tech firms such as Huawei. These are their takeaways.

The current environment presents attractive valuations for many companies following a prolonged selloff. The government seems to be shifting its focus toward supporting the economy, particularly by potentially stabilising declining home prices, which could positively impact household savings, economic growth, and investor sentiment. Recent policy changes, such as reduced down payments and mortgage rates, along with plans to convert unsold properties into affordable housing, signal a shift in support for the economy. This pivot may help improve sentiment and valuations, potentially aligning with 3% to 5% GDP growth over the next few years, although there are no immediate solutions. If policymakers can successfully address challenges in the property sector, consumer sentiment and the overall economy could see improvement, leading to potential equity gains.

The current business landscape in China indicates a shift towards more disciplined capital allocation and shareholder-friendly measures. Companies are prioritising cost-cutting, divesting unprofitable ventures, and returning more money to shareholders through dividends and stock buybacks. For example, Meituan, Tencent, and NetEase have all announced significant buyback programs and dividend increases. If Chinese companies continue to generate positive free cash flow and follow through on their commitments to shareholders, it could result in a more balanced profile of stock returns in the future.

China’s EV industry has seen significant growth, with companies such as Xiaomi and Huawei making impressive strides. Xiaomi has successfully launched its first EV and built an automated manufacturing plant, while Huawei is selling software and partnering with manufacturers. Despite the innovation, some investors are cautious due to industry oversupply and a potential price war. They are considering opportunities to invest in EV suppliers while waiting for a potential wave of consolidation in the market.

Consumers have become more price conscious and cautious. Discount e-commerce platforms are thriving, as well as some domestic consumer brands and travel-related businesses. Despite a softening in luxury goods spending, domestic travel has rebounded, surpassing pre-pandemic levels. In Macau, there are indications of a continued recovery, with overall visits tracking higher than last year. Casinos have focused on adding family-fun attractions to diversify away from gaming. Additionally, some high-net-worth individuals have shifted spending to Japan. Despite recent challenges, China is expected to retain its importance as a top market for luxury brands. Bottomline The Capital Group team says it saw value emerging in select industries and companies such as internet services, domestic leisure and travel, the EV supply chain and industrial automation. China will remain central to the global supply chain in many industries for the foreseeable future. They believe investors have to adapt to the new reality, which is lower GDP growth (3%-5%) for China and fixing the country’ s property market model. Despite these headwinds, they believe there are — and will continue to be — investment opportunities. We only have to look back to a video from 1983 to appreciate the power of tech. A young, enthusiastic Steve Jobs is addressing a conference of designers in a tent at Aspen. He wears a bow tie, “because they paid me $60”, drops his jacket on the floor, and swears a few times (moderate course language warning), but most importantly, he confidently predicts how we will use computers in that decade and beyond. (click on the photo for the 2 minute version). |

Grandparent Economy: The Bank of Nan and PopThe wealth set to flow from Baby Boomers to other generations over the next 10 years has been revised up to $4.9 trillion, so it will be no surprise that we at The View and others in the financial services and family law sectors are focused on estate planning and its legalities. Given so much wealth to be passed on, it’s not surprising that there is predicted to be a significant uptick in wills being challenged. Recent research by ANZ Private Bank has found that about 70 per cent of intergenerational wealth transfers fail because of dissipating wealth, family conflicts, misaligned family values, delays and bungled execution. Lawyers warn about the potential for bitter, protracted and expensive legal disputes potentially involving grandparents’ estates, adult children and their spouses, grandchildren and stepchildren from blended families. Last month, The View included “Six questions to ask your adult children before writing a will”. This month, we’re looking at the next generation of beneficiaries. The Australian Financial Review (AFR) recently reported that growing numbers of grandparents were bypassing their already wealthy or comfortably well-off children in favour of their grandchildren, worried they would struggle with the cost of living and extreme house prices. The AFR said the number of wills naming grandchildren as beneficiaries has tripled over the past five years to about 10 per cent, and the share of assets has more than doubled to 12 per cent. CoreData, the financial services research firm, estimates that $2.3 trillion of Baby Boomer wealth will go to their children, $1.7 trillion to charities and other family members and the remaining $931 billion will flow directly to their grandchildren. Grandparents are wary of having their savings used as part of a settlement in a child’s divorce or blended family disputes involving stepchildren. Some are opting to support their grandchildren now rather than wait – known as the “giving while living” approach – providing them with private school and HECS fees, holidays, help with mortgages and everyday living expenses. “Co-saving” is another approach – matching whatever a grandchild saves towards a major purchase, such as a car or house. More traditional grandparents who are waiting until their deaths to pass on their wealth are looking at protecting their assets and tax benefits with a testamentary trust, which holds on to assets on behalf of an individual or group of beneficiaries. Income can be distributed to under-age grandchildren or great-grandchildren who earn no other income rather than to adults who might already be on high marginal rates. A testamentary trust can also make loans to a beneficiary, which might be used to buy a house if permitted by the trust’s deeds. The trustees can decide loan terms that do not have to be commercial. The downside is establishment and ongoing costs with testamentary trusts, so the estate would need to be somewhat substantial (at least $500,000) to justify the expense. The upshot is that grandparents do need to carefully plan their wills to reduce the risk of family conflict. Children, who might initially support a will that skips their generation in favour of grandchildren, can change their minds later in life if they become more needy, ill or have a costly divorce and decide on a legal challenge for a share. When discussing plans and any agreement with your children, be clear about what it means for all parties, and ensure that it is fully documented and reviewed by an experienced lawyer. A child can challenge a parent’s will because courts still consider the primary moral obligation of a parent on death, to be to the children rather than grandchildren. However, a recent case in the NSW Supreme Court has interesting implications for grandchildren. In the Curtis v Curtis case, two brothers challenged their grandfather’ s estate, which solely went to their uncle. Their father had died in 2003, and the grandsons argued they had a dependent relationship with their grandfather, although not a financial one. While the plaintiffs ultimately had their family provision orders overturned on appeal, the case illustrates several critical points, particularly on the eligibility of grandchildren if they can prove (with credible evidence) partial or whole dependency on the deceased. The case underscores the importance of careful estate planning and consideration of potential claims from dependents, including grandchildren. If you are involved in estate planning or facing a potential family provision claim, it is crucial to seek professional legal advice to navigate these complex issues. |

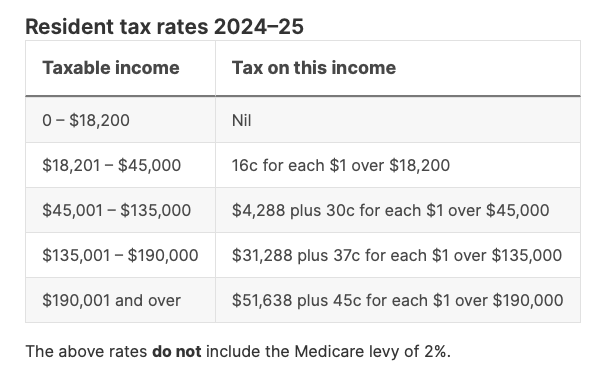

Bracket Creep 101Taxation by stealth or a necessary evil, “bracket creep” is loved by politicians and hated by economists and has been part of Australian working lives since the early 1980s. Here’s a guide to try and understand it. What is Bracket Creep? As of July 2024, Australia has updated its five different tax brackets: The more you earn, the higher your marginal tax rate in that bracket. That’s “progressive taxation”, which is adopted practice in almost every country because the more you earn, the more capacity you have to pay and contribute to the country’s general revenue. Bracket creep occurs when rising incomes cause individuals to pay an increasing proportion of their income in tax. As tax brackets are typically fixed in nominal terms, your increased nominal income may push you into a higher tax bracket, resulting in a higher effective tax rate. Politicians love bracket creep because in periods of increasing inflation, they don’t have to raise taxes. Inflation keeps moving wage earners into higher tax brackets, so they end up paying more. The standard solution to bracket creep—practised by the US, Canada, Denmark, Sweden, and other European countries—is to automatically index all the tax brackets each year, raising them by the rate of inflation. History of Bracket Creep in Australia The Fraser Government did flirt with automatic indexation briefly in 1976 before deciding it wasn’t worth it politically. The annual tax cuts it produced were small and automatic, so the media and taxpayers took too little notice of them. After moving to half indexation first, automatic indexation was abandoned completely in 1981. Malcolm Fraser decided it was smarter politics to delay having tax cuts until you could afford to have a big one, like every three years, around election time. And why give everyone the percentage cut in taxes when you could play favourites by cutting tax rates on some brackets more than others, especially at the upper end? Sound familiar? Why is bracket creep complicated? At what point do you start indexing? Indexing thresholds means drawing a line in time and saying this is the ideal level of taxation rates, and indexing will occur from this point. Politicians get confused by bracket creep as well. When he was trying to sell the original Stage 3 tax cuts, former treasurer Josh Frydenberg told Parliament that it would tackle bracket creep. “ If you get another job or a promotion, or you do some overtime, you won’t necessarily pay a higher marginal rate of tax,” he said. But if you get a promotion or another job that pays more, that’ s not bracket creep – that is just you getting a better-paying job, and under progressive taxation, you can now pay a bit more in tax. Back in April, The View shared CBA boss Matt Comyn’s ideas for restructuring Australia’s personal tax rates. Under his reform, the first $20,000 of earnings would be subject to no tax, then 20% tax on incomes above $20,000 up to $80,000, 30% on incomes above $80,000 up to $300,000 and a top rate of 45% above that. All personal income tax deductions would be abolished, except for charitable donations. Still no mention of indexation, however. |

Sure Sign Our Banks are Betting on a Rate CutAnalysts and commentators alike believe Australia’s banks have decided a cut is coming. The sign? The fact that in recent weeks, more than a dozen Australian banks have cut their fixed home loan interest rates despite the RBA ruling out cutting the cash rate in the near future. NAB was the first Big Four bank to cut fixed rates back in July, with CBA and Westpac following suit in August. They have been joined by most other lenders bar ANZ at this stage. To recap, the RBA has hiked the official cash rate from a record low of 0.10 to 4.35 since May 2022 but has kept interest rates on hold at their 12-year high since the end of last year. Not surprisingly, most banks are cutting their longer-term fixed rates, where they have the most opportunity to offer comparably low rates now that will most likely end up higher than variable rates during those fixed terms. The decision of whether or not to fix your mortgage at this time is a balancing act. It could give you peace of mind and protect you from future rate cuts, or you could miss out on savings later on should rates drop. Most finance experts say that with the chance of further rate cuts on the horizon, variable rates could very well drop below the lowest fixed rates now on offer, so you could be stuck paying a higher rate after the RBA starts the cutting cycle. If you’re tempted by the fixed rate offers, please feel free to contact our mortgage broker, Brenton Moyle from FinSec Finance, before you make a decision. Last word to RBA governor Michele Bullock, who must feel like a broken record, saying again in September that talk of interest rate cuts was “premature”. “If the economy evolves broadly as anticipated, the board does not expect that it will be in a position to cut rates in the near term,” she said. Bullock said she and the board understood interest rates hurt households but noted high inflation “hurts everyone and especially the most vulnerable”. |

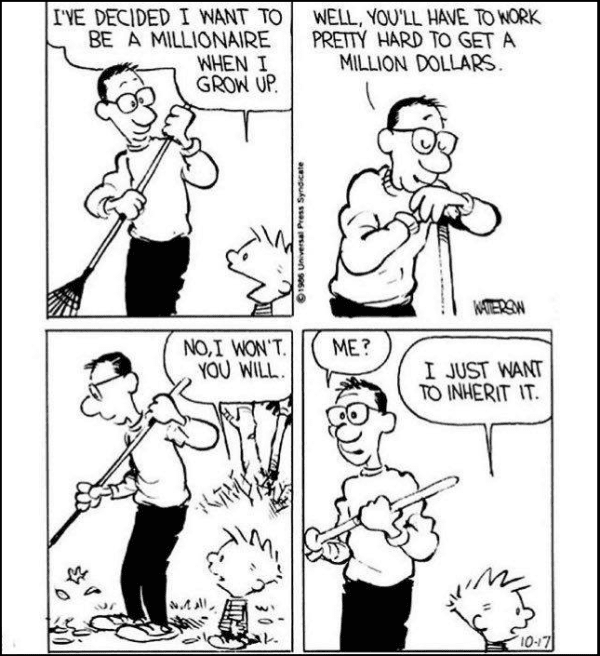

Friday FunnyIt’s been 30 years since Bill Watterson finished writing his Calvin and Hobbes comic strip but it seems the more things change the more they stay the same! |