Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A FinSec View – Local & Global market updates, Writing a Will?, Exchange Rates 101 & much more….

| 30th August 2024 |

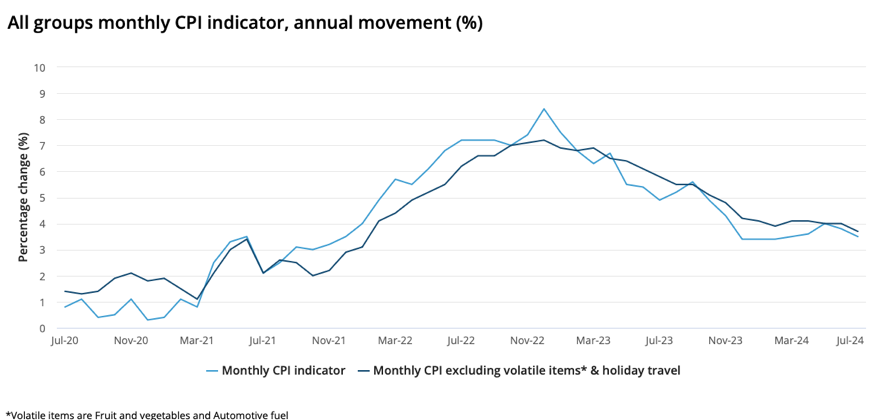

Australian Market UpdateHaving started the month with a 6% market correction in reaction to a sharper than expected uptick in US unemployment we finish the month exactly where we finished July. Nothing to see here, onwards and upwards!! After lukewarm if not cold predictions of a likely rate cut this side of Christmas, financial markets at the start of this week started confidently pricing in a cut by Christmas and another two by May 2025. Bond traders no longer believe Reserve Bank Governor Michele Bullock (we do) when she says that interest rate cuts are unlikely in coming months. Our Global Market Update below explains where this optimism stems from, however, just to show this all feels like ‘swings and roundabouts’, by midweek traders were modestly dialling back bets of interest rate cuts after monthly inflation cooled at a slower pace than anticipated. While inflation fell to its lowest level since March, helped in some part by a 5% annual cut to electricity prices, as billions of dollars in government rebates kicked in, it was .1% less than anticipated. The monthly consumer price index indicator from the ABS released on Wednesday (August 28) showed the CPI slowing to 3.5%, down from 3.8% in July. The most significant price rises were in housing (up 4%), food and non-alcoholic beverages (up 3.8%), alcohol and tobacco (up 7.2%) and transport (up 3.4%). Energy prices have fallen back to the level they were at a year ago thanks to significant government subsidies on electricity bills paid out in July. The housing market is showing some sign of slowing but the rental market will continue to put pressure on inflation. We expect energy costs to be back up the leader board soon as well, once the subsidies end. August has been an interesting reporting season for the ASX. The weak earnings outlooks for miners, off the back of a struggling Chinese economy, and high prices from sectors such as the banks have forced investors to chase better growth prospects in an increasingly smaller pool of ASX-listed companies, further driving up share prices. According to new JP Morgan data, share prices of many ASX-listed companies have outpaced their earnings during this reporting season – approximately 40% of companies issued downgrades and earnings declined by 2% indicating a potential lag in earnings growth for the foreseeable future. Yet stock prices on the ASX have soared with the price-to-earnings ratio reaching about 18 times the highest rate since the COVID pandemic. Consequently, share prices and earnings are moving in opposite directions, creating a rare market situation. This is surely a sign that markets have already priced in rate cuts. Australia’s largest-listed companies are currently at their most expensive levels in history; Commonwealth Bank reset a record high earlier this month and is now the most expensive publicly listed bank in the world, with a price-to-earnings ratio of about 24 times. Investors are willing to pay a premium for companies with better growth prospects amidst the scarce growth opportunities on the ASX. As a result, share prices in the ASX’s mid-cap sector have surged ahead of earnings at some of the fastest rates globally, outpacing the S&P 500 since the start of the year. Logistics software giant WiseTech’s stock price jumped more than 20% after reporting results, despite missing the consensus revenue forecast. The consensus is that investors should “hasten slowly” when entering the market at these levels. Interest rates, industrial metal prices, weak Chinese growth and equity market volatility have kept the AUD between US$0.64-0.68 cents for some time. At the start of August, it was sitting around USD 0.6522 but after the US Federal Reserve Chair’s positive speech on August 23 our dollar jumped by more than 1% to USD0.6790, finding stability around 0.6725. After Wednesday’s inflation figure, it rose to 0.68. When the US Federal Reserve does cut rates, the AUD is likely to climb. Merely by continuing to cut their interest rates, the US and other countries will be helping to ease inflation in Australia. The more they do it, the more Australian inflation will ease, building up a stronger and stronger case for our Reserve Bank to cut rates. Having said this, RBA Governor, Michelle Bullock has been very clear that rates will not drop until the new year and (as referenced above) – we believe her! |

Global Market UpdateAll eyes in August were on a small fly-fishing town in the US Midwest: Jackson Hole, Wyoming. There, in a room full of the world’s central bankers including Andrew Hauser, the Reserve Bank of Australia’s deputy governor, US Reserve Bank chair Jerome Powell (pictured below at Jackson Hole) uttered an eagerly anticipated forecast that has been interpreted as the long-awaited US rate cuts were about to begin. “The time has come for policy to adjust,” Powell said, with clarity. US inflation has eased (for the second month in a row), and its labour market has cooled, as have wages, and while Powell stopped short of promising a September rate cut he said: “The direction of the travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” he said. On Wall Street, the speech was taken as effectively a guarantee that rates will be lowered next month. “Chair Powell’s Jackson Hole speech confirmed that the Fed is now at the point of paring,” wrote the Bank of Montreal. “ Indeed, we judge we’re also now at the point where the data no longer have to persuade the Fed to cut policy rates.” The US would join the UK, China, Canada, New Zealand, Switzerland, Denmark, the European Union, and a host of other jurisdictions in cutting rates – some of them repeatedly – to shore up their economies. Financial markets are pricing in the equivalent of four ordinary-size rate cuts in the US by the end of the year. Given the US Fed has only three meetings left this year, this implies they are expecting at least one cut to be a double. The question is, will rate cuts by the US Fed and other central banks create near-irresistible pressure for Australia’s Reserve Bank to follow? Central banks tend to move rates together (but not always at the same time) we expect Australia will be 6 months behind other major global economies which have or are opting for cuts, and wait until 2025 before delivering 4 cuts which will see our cash rate bottom out at 3.35% by the end of next year. There were markedly different moods and events between the US and the UK in the past month with the razzle-dazzle of the made-for-TV party conventions in the US presidential contest, now a more even race with Karmela Harris disrupting Trump and his MAGA campaign, contrasted with the shocking rioting across communities in England. Meanwhile in the UK, Prime Minister Sir Keir Starmer has strongly flagged tax rises in his Government’s October budget, warning he will have to make “painful” decisions after finding what Labour says is a £22bn black hole in the public finances. While the extent of the tax rises is unknown, middle-class families are reportedly preparing for a capital gains tax raid after Starmer said those with “the broadest shoulders should bear the heaviest burden”. Wealth managers claimed Starmer’s speech triggered phone calls from panicked clients; middle-class savers are rushing to sell shares and property to avoid paying higher rates if capital gains tax is increased. There is mounting speculation that Labour could align capital gains tax with income tax, potentially increasing the higher rate from 20 per cent to 45 per cent, given Starmer has repeated his election promise not to raise National Insurance, VAT or income tax. Many landlords are expected to sell their properties to avoid paying any increased levy, leading to an exodus from the buy-to-let sector. |

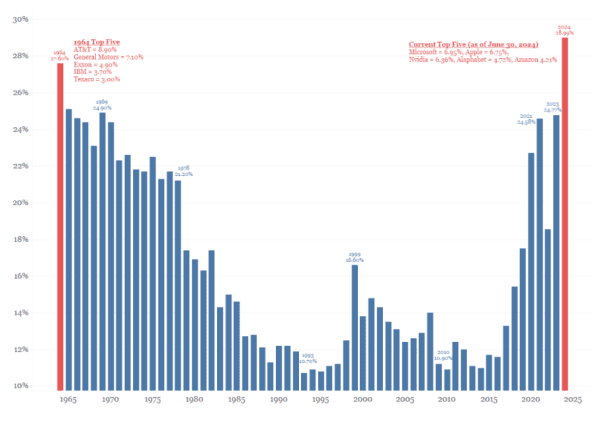

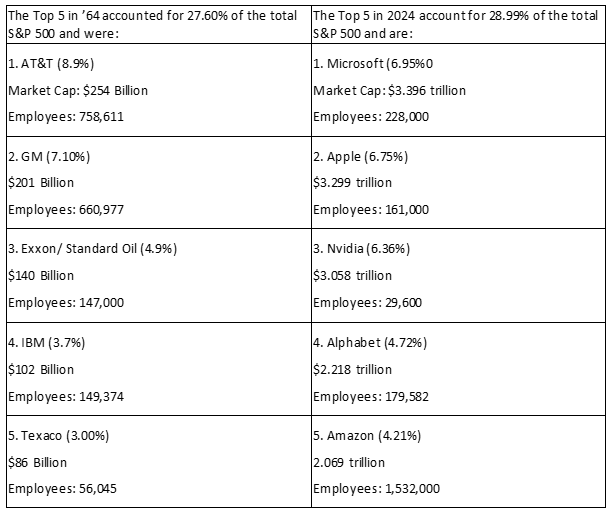

Chart of the MonthIf ever there was a time to use the cliché, “the more things change, the more things stay the same,” it’s looking at this chart comparing the Top 5 companies concentrating the S&P 500 in 1964 with those as of June 30 this year. Market concentration was at its lowest in 1993 at just over 10 per cent, but the level in ’64 and 2024 is almost equitable. Led by the Magnificent Seven stocks that have captured investor attention this year, the concentration of market capitalisation in a handful of US equities is the highest in decades. While for some, a chart such as the one above showing such elevated concentration is a sign of risk, other historical observers argue the US market has rallied more often than it has declined in the 12 months after other periods of high concentration. Goldman Sachs researcher Ben Snider is one who believes that based on history, the tech-heavy stock market still has room to run higher. That’s because after every market concentration, he says, the laggards in the market tend to rise when the frontrunners start to lose momentum, propping the index higher. “This supports our view that a ‘catch up’ by laggards is more likely to interrupt the ongoing momentum rally than a ‘catch down’ by the recent market leaders,” Snider says. The behaviour of the US market today draws many comparisons to the extreme equity market concentrations of 1973 (Nifty-Fifty bubble) and 2000 (dot-com bubble) when stocks slipped into a prolonged bear market or downturn. However, 1964 is a different story. After market concentration peaked that year, both share prices and the US economy remained healthy for an extended period. The ‘64 experience shows that an ongoing bull market can continue to increase even as market concentration declines. And just as in 1973, 2000, and 2024, 1964 coincided with low unemployment and a strong equity market backdrop. Crystal ball, anyone? |

For AI lessons, turn back to 1983In 2024, rapid technological advancements have firmly established artificial intelligence (AI) as a cornerstone of innovation across various industries. From enhancing everyday experiences to driving ground breaking discoveries, AI continues to transform how we live and work. The proliferation of AI apps is making it possible for businesses and individuals to harness the power of this transformative technology. As our Chart of the Week shows, stock markets globally, but particularly in the US, are entirely focused on the top tech companies, which are all immersed in AI. The recent massive rise, correction and rise again of Nvidia is a case in point. Most analysts agree there will continue to be market corrections of the major players in the sector, and this is not a sign of weakness. It undoubtedly remains a critical component of any portfolio. We only have to look back to a video from 1983 to appreciate the power of tech. A young, enthusiastic Steve Jobs is addressing a conference of designers in a tent at Aspen. He wears a bow tie, “because they paid me $60”, drops his jacket on the floor, and swears a few times (moderate course language warning), but most importantly, he confidently predicts how we will use computers in that decade and beyond. (click on the photo for the 2 minute version). His statements are so eerily profound that it’s worth setting aside 55 minutes to watch this video in full (click here). He says computers are already so fast they are like magic. He says Apple’s aim is to “put an incredibly great computer in a book that you can carry around with you that you can learn how to use in 20 minutes”. The first MacBook was released in 2006 and when the iPad was launched in 2010, it was called “a truly magical and revolutionary product”. Jobs predicts people will spend more time interacting with personal computers than with their cars in just a few years—remember, this was 1983. He says computers will help us network and describes early e-mail systems and how people will be able to pick up their e-mail while walking around. The first PC was launched in 1976, and Jobs says three million will be sold by mostly IBM and Apple in 1983. By 1986, he says, that will be 10 million. “People are going to suck the stuff up so fast it doesn’t matter what it looks like,” he says before asking the design community for help to design beautiful products. At the time of the Aspen conference, Apple stock was US13 cents. It’s now about US$213. The company is worth US$3.32 trillion, nearly double the value of the entire Australian Stock Market. Imagine what Nvidia will be worth in 2064. |

Six Questions to ask your adult children before writing a willSometimes, a story heading just makes you want to read on, right? Same for us at The View. We couldn’t resist sharing this practical advice from the AFR. 1. If you were to inherit money or other assets, what would you do with it? Asking this straightforward question will give you valuable insight into your children’s financial values, literacy and long-term goals. It will reveal how they prioritise their spending, saving, investing or interest in charities and show their level of maturity when it comes to making significant financial decisions. The ideal answer: a balanced approach to saving and investing, a willingness to spend wisely and use the services of professional advisers and a desire to give back to the community. 2. If you divorce your partner after my death, would you like your inheritance protected from a property settlement? Regardless of their answer, protecting your child’s inheritance from their spouse is prudent, given there are more than 50,000 divorces in Australia annually and many more de facto separations. An experienced lawyer can give you advice, such as drafting a testamentary trust that can help protect an inheritance forming part of your child’ s property settlement. 3. Would you like me to leave a family legacy asset, such as a farm or holiday home? This will help you gauge whether your children can financially and emotionally enjoy and, in the case of siblings, share a real estate asset. Or, whether they would benefit more from receiving shares or cash. If there are multiple beneficiaries managing an asset, they may have different ideas and views. The answers should reflect a genuine appreciation of this family legacy rather than its financial benefit, a sincere interest in the asset and a commitment to maintaining it, and ideas for its future use. 4. Would you like some financial coaching? Receiving a significant inheritance can be life-changing for the beneficiaries, but not always in a positive way. It can remove the need to work or achieve, lead to relationship breakdowns, and negatively impact long-term happiness. Some people just do not have the financial literacy or emotional intelligence to handle such an inheritance. Your child’s response will show you how open they are to receiving advice or coaching and what importance they are giving your money over family, friends and experiences. 5. Do you understand my values and choices? How well have you communicated your own financial decisions and choices in the past? Do you want your children to follow in your footsteps or branch out on their own? This question is aimed at arriving at a mutual understanding of each other’s motives and values. 6. What would you like to see happen with the family wealth over the next 50 years? Given that wealth accumulated by the first generation is often lost by the third through mismanagement and imprudent spending, this is an important question. You need to provide a space for an honest conversation and where your children have the confidence to share their ideas. Parents usually want to hear their children demonstrate an understanding of being a custodian or trustee, of being a receiver, not just a spender, and of providing a positive future for their grandchildren and great-grandchildren. |

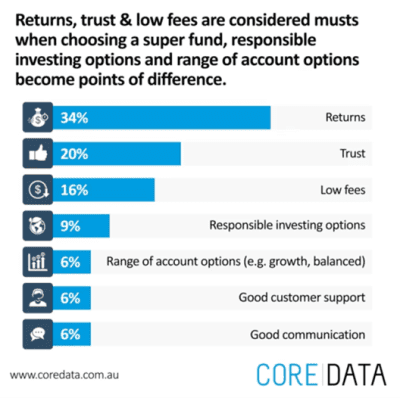

This figure was surpassed in the last quarter by Australian superannuation balances, and with 3.6 million Baby Boomers preparing to retire in the next decade, it’s not surprising that there is intense regulator, government, and, importantly, customer scrutiny of not just performance but what our funds communicate and market to us. A recent social media post by Andrew Inwood, global CEO of research giant CoreData, about 20 years of tracking trust in super funds caught our eye. “When choosing a superfund, the strongest driver of choice is returns, but coming in second is trust, considered by Australians to be more important than low fees,” according to Inwood. “Smaller funds and faith-based funds are much more trusted than larger funds, while inferred trust — a recommendation from an adviser or a friend or a workplace — outweigh almost everything else.” Bizarrely, though, the more interaction we have with a superfund, the more our trust in them starts to wane. Inwood: “The other thing worth understanding is that as members interact with their superfund, their trust starts to slide. The halo created by the building of the brand of superannuation has been substantial, but recently the data around less than perfect service means that as contact frequency goes up, trust starts to slide.” Australia used to be the gold standard of super; we’re now seventh globally behind the Netherlands, Scandinavian countries and Germany. Inwood told the Australian Financial Review recently that Australian superfunds’ poor communication record with their customers was causing churn in the sector. “People are starting to move around a bit – they’re saying, ‘we’ re cheap’ (as in wanting low fees), but they’re not as cheap comparatively as they used to be,” he said. “There’s also a certain point in your life where you say, ‘well I want safe now, I don’t want just cheap. Cheap is fine between 18 and 50 years old, but after 50, when I’ve got real money, I want safe and high service’.” |

First Home Buyers & Single Parents get more housing supportThe federal government has allocated another 50,000 places across Australia to its Home Guarantee Scheme (HGS) for the 2024-25 financial year. That includes 35,000 places for the First Home Guarantee and 10,000 for the Regional First Home Buyer Guarantee. Under the first program, the government supports eligible first home buyers to purchase a property with a 5% deposit, without having to pay lender’s mortgage insurance (LMI). The second program is identical but applies to regional applicants purchasing regional properties. The HGS also includes 5,000 places for the Family Home Guarantee, through which the government helps eligible single parents and single legal guardians to purchase a property with a 2% deposit, without paying LMI. For all three schemes, applicants must be owner-occupiers. Income caps apply ($125,000 for single applicants, $200,000 for joint applicants), as do property price caps (which vary from state to state). The HGS has strict conditions and is not available through all lenders. If you know some who may be eligible and would like to know more, we have specialists in our finance broking arm, Finsec Finance, please contact us to arrange an introduction. |

Exchange Rates 101Most of us pay attention to exchange rates at the end of the finance segment on the nightly news, when the Aussie dollar is commonly compared to the US dollar, pound, and Euro, and really only care when we’re about to travel overseas or book another holiday. Is worrying about fluctuations in currency exchange rates when you’re travelling a bit like shopping around for cheap petrol? At the end of the day, how much are you really saving by driving further? What is an exchange rate? Simply put, an exchange rate is the price of one currency in relation to another. When you exchange money from one currency to another, the rate at which you do so determines how much foreign currency you’ll get in return. If the exchange rate between the Australian dollar (A$) and US dollar (USD) is 0.66 it means that A$1 is worth 66 US cents. How do they work? Exchange rates are influenced by the global market’s supply and demand for currencies. Factors affecting supply and demand include high or low interest rates, inflation, economic and political stability, geopolitical events, and natural disasters. Central banks and financial institutions play key roles in managing a country’s currency supply and stabilising exchange rates. There are two main types of exchange rates: Floating: Most major currencies have floating exchange rates, which are determined by global supply and demand. Fixed: These are set by a government and maintained at a specific level. Some countries peg their currency to another major currency like the USD to keep it stable. How do exchange rates affect you? Exchange rates affect prices when travelling, importing or exporting goods, and investing internationally. Small fluctuations in exchange rates often don’t have significant consequences for everyday consumers, unlike for businesses involved in global trade or investments. For travellers, focusing on budgeting and spending wisely is more beneficial than obsessing over daily exchange rate changes while you’re away. Mild fluctuations in the Aussie dollar shouldn’t drastically alter your travel budget. If it improves by a few cents, you might enjoy slightly better value on purchases and dining out, but it won’t make a huge difference overall. On the flip side, if the exchange rate worsens, you might need to be a bit more mindful of your spending, but unless the fluctuation is dramatic, it’s unlikely to ruin your trip. Savvy travellers budget and spend wisely, use prepaid travel cards or transaction cards with low or no conversion fees and withdraw cash from local ATMs. Bon voyage. |

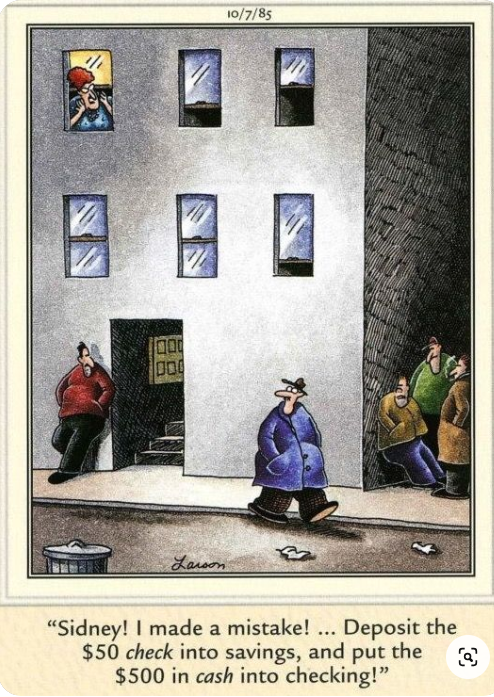

Friday FunnyIt a time when we all work so hard to protect our data from scammers, todays Friday Funny by Gary Larson’s Far Side series highlights that even 40 years ago it was too easy to forget basic security! |