Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Bulls V Bears, Virus Mutations and a Broken Insurance System

Issue: Friday 19th March 2021

It is a year since the World Health Organisation declared COVID-19 a global pandemic. The USA was about to close its borders, and Australian’s were about to start tackling each other for loo paper. Hard to believe that 12 months on and equity markets have surged back, the majority beyond pre-pandemic highs.

Now the talk is of recovery, rising rates and inflation. So, where do we stand one year on?

It seems to be a matter of opinion. On Wednesday, markets rallied (the Dow and S&P 500 both closed at a record) after the Federal Reserve once again vowed it would maintain easy monetary conditions, only to finish sharply lower on Thursday after another jump in U.S. Treasury yields. The NASDAQ dropped to 12,600 points earlier last week only to roar back, just when people were calling a major fall in tech prices.

While markets always have differences of opinion, at the moment it feels as if experts are further apart than we can ever recall. At one end is the ‘bounce back’ theory of strong consumer spending. At the other is the overvaluations during a pandemic with mutant virus threats.

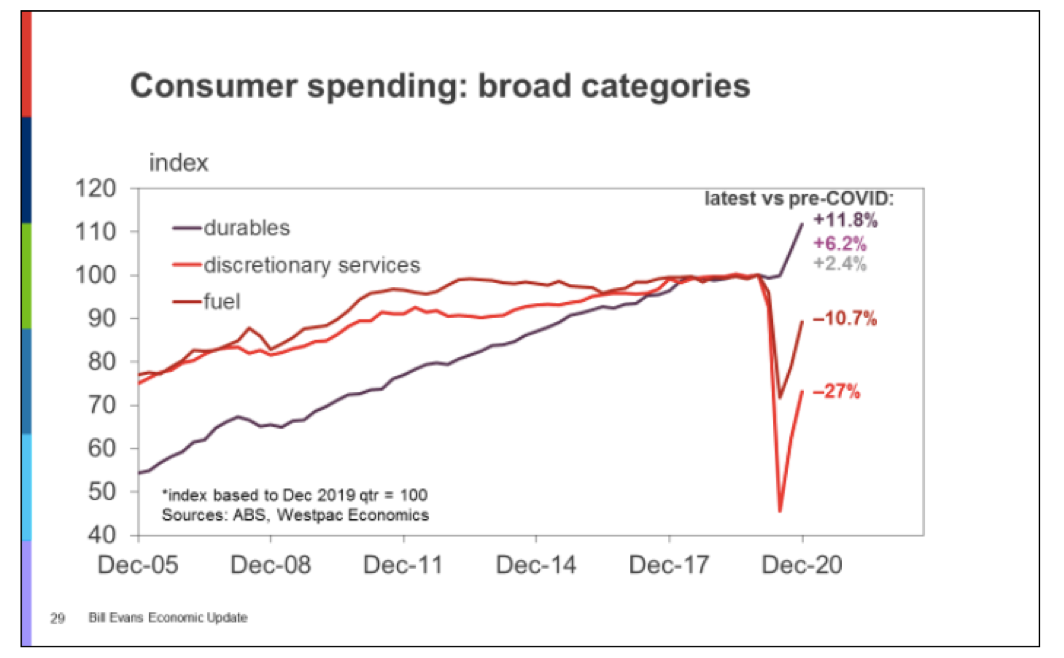

The strongest argument of the bulls is the rebound trade. Some fund managers believe that when Americans and Europeans emerge from the pandemic and lockdowns, the burst of buying activity will lead to a massive economic rebound. If Australia is anything to go by, then perhaps they are right.

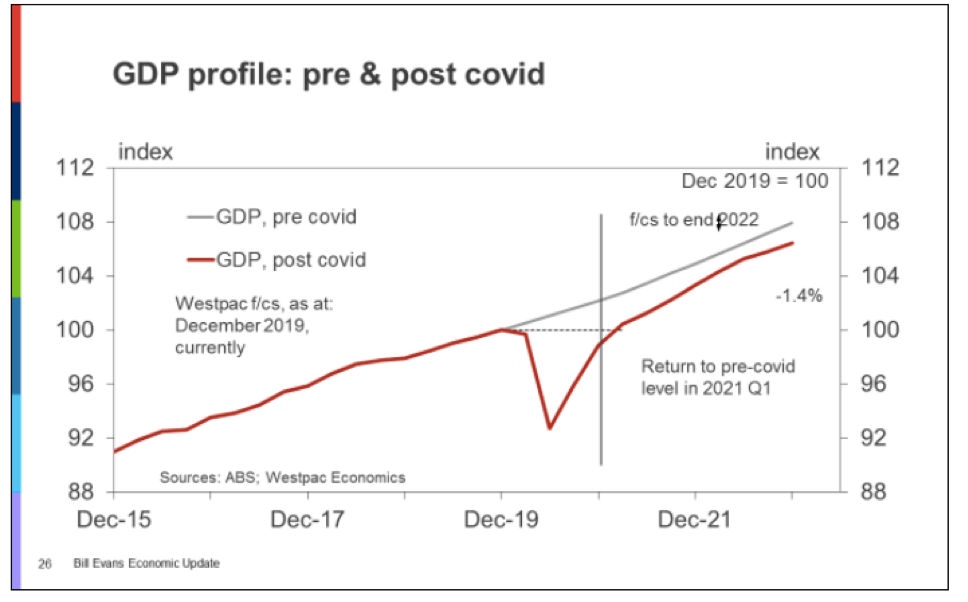

February’s employment numbers were in yesterday, and “there are now more jobs in the Australian economy than there were before the pandemic,” according to PM Scott Morrison (note: people on JobKeeper are not counted in the unemployment figures). Economists everywhere are bringing their forecasts forward off the back of 1st quarter data, the strength of which we didn’t expect to see until late 2021 at the earliest.

The key dynamic in all of this is of course, household expenditure or savings to be exact…

The household sector built up a huge level of savings during the pandemic (an estimated 200 billion), and we witnessed a release of these savings during the December quarter. This phenomenon helped to counteract the end of JobKeeper 1.0 and, with a substantial buffer still in place, hopefully a lifeline when JobKeeper 2.0 ends on the 28th March.

On the bear’s side we have a global pandemic vaccine roll-outs withstanding, there is still a long way to go. And then there are markets. No one can deny the many signs of excess, of overvaluation, of hubris, of overconfidence. We know there’s something weird when Bitcoin hits US$50,000, Tesla is worth more than all the other large car makers in the world combined, and governments borrow and spend unlimited amounts (U.S. Government stimulus packages during COVID are now worth over US$7 trillion … that’s US$7,000,000,000,000).

What do we think?

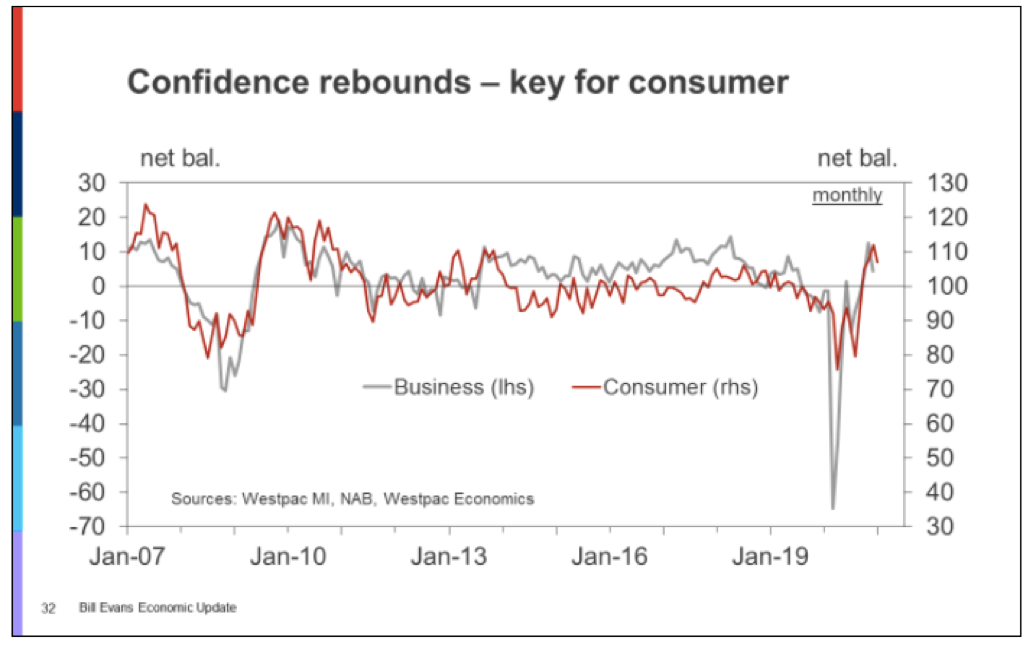

The end of JobKeeper 2.0 will be rocky, but $200 billion in household savings is not a bad buffer. Consumer confidence will be paramount, and both vaccines and mutant strains hold the game-changing moves here.

Let us not forget that there will be some pain, particularly in the corporate sector. Insolvencies in 2020 were half that of a typical year and we expect to see a difficult six months in this space.

Despite the Fed and RBA touting the virtues of patience, markets seem overly anxious to price in early rate hikes, and they will continue to react erratically on the slightest morsel of news.

We do believe it will be lower for longer. With so much spare capacity in the labour market, inflation pressures just aren’t there. While headline inflation is likely to spike in the months ahead – higher energy and commodity prices and bottlenecks in some goods markets – underlying inflation and wages growth are likely to remain soft compared to the excesses usually seen prior to cyclical downturns. As a result, while Fed and RBA rate hikes may come earlier than the three years or more they refer to, it is still likely to be at least a few years away. And, the ECB and Bank of Japan are likely even further behind.

The great inflation spikes through history were nearly all to do with money printing by governments to finance their wartime efforts ‘the engines of growth’. But the COVID war is not yet over. In our view, it is a little too soon to be thinking victory is nigh.

Here at FinSec we remain measured in our approach. As entrepreneur Jim Rohn once said, “discipline is the bridge between goals and accomplishment.”

On the Markets and the Bull v Bear arguments…

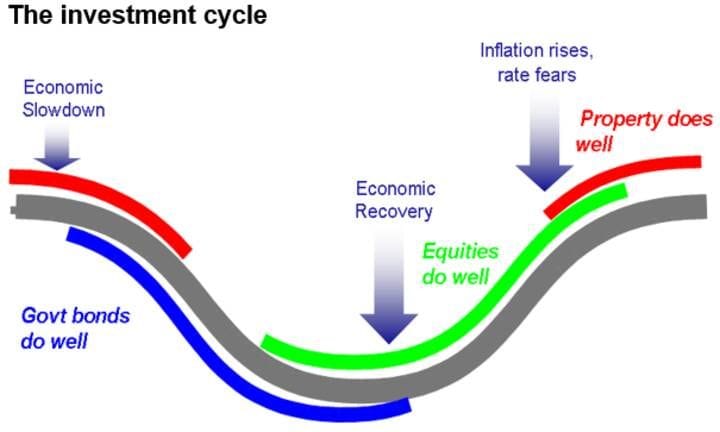

In this article Economist Shane Oliver provides his view on where we are at in the investment cycle. He suggests:

- The history of cyclical bull markets in shares shows that the rebound since last March still has a way to go.

- That it is normal for the second 12 months of a cyclical bull market to see slower returns from shares.

- While shares are vulnerable to a further correction triggered by the spike in bond yields, we are not seeing the sort of unambiguous overvaluation, economic overheating, monetary tightening and investor euphoria normally seen at cyclical tops.

- In a world going through one challenge after another, how do we choose performance and safety together for investing into the middle of this decade? He believes that ultimately cheaper, less tech heavy, non-US share markets including Australian shares are on the money.

Read the full article here.

No Margin for Error

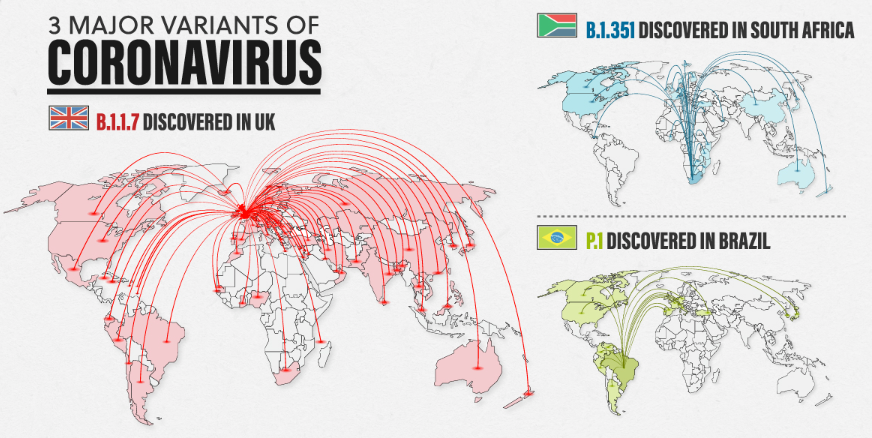

This week we share an article and webinar video by Hamish Douglass, the Chairman and CIO at Magellan where he gives a detailed review of vaccine developments, with a sobering outlook for mutations. Hamish says he reads a couple of scientific papers a day, and he is at the cautious end of fund managers. He says risks are foreseeable and investors could have their “shirts ripped off” if something goes wrong, and he sees “clear speculative frenzies” in some assets.

“There is no margin for error in markets at the moment. At one point you want to have risk on because of the stimulus and the economic recovery holding up, but there are other warning signs that you could have your shirts ripped off if something goes against you it is very foggy out there.”

Questions covered:

- Why do you think 2021 is the Year of Living Dangerously?

- Should we have confidence in the vaccines?

- How likely is a strain so mutant that it derails the assumed economic recovery?

- How easy would it be to recode the current vaccines for an escape mutation?

- If the vaccines become less effective in preventing infection, should we take comfort that they remain effective in preventing deaths?

- Why are investors ignoring the risk of mutant strains?

- What is the biggest scientific known unknown at the moment?

- How should investors be thinking about risk in the environment?

Watch the webinar here or download the PDF here.

Image source: Visual capitalist

APRA Demands Action on Life Insurance

Australia’s broken personal Insurance market is a topic we have touched on in previous views. With premiums now at historical highs and set to skyrocket further, intervention is both necessary and well overdue. It was therefore pleasing to read earlier this month that APRA has decided to weigh in on the issue. The regulator is calling for industry participants to ensure the cover offered to super members accomplishes “a balance of giving them meaningful cover at an affordable price”.

“Ultimately, APRA expects all participants in the industry to take note of concerns and take appropriate steps to address them. Should APRA not see evidence that life insurers and [registrable superannuation entity] licensees are addressing these matters, APRA will consider action.” AFR, March 9th 2021.

Superannuation life insurance caused ‘unprecedented’ losses over 2019 and 2020, which has correlated with a hike in member premiums.

Paradoxically, the rise in premiums is in part the result of an industry and government attempt to make the super system fairer. Legislation aimed at people under 25 and those with accounts with less than $6,000 back in April allowed them to opt out of paying insurance on all but one account. However, the effect of this has been a drop in the number of people paying super insurance – effectively ‘draining the pool’ (APRA data revealed a 15% decrease) – which has in turn meant that insurers needed to increase premiums paid by other members.

Additionally, the pandemic has led to a rise in mental health issues in Australia, now sitting just behind cancer as the most common reason for making a claim. Whilst premium increases are never welcome, there is a direct link between the total amount paid out in claims and the cost of premiums.

With 70% of Australians holding life insurance through superannuation (many of those underinsured already), we hate to think of the ultimate consequence if this issue is not meaningfully addressed and soon.

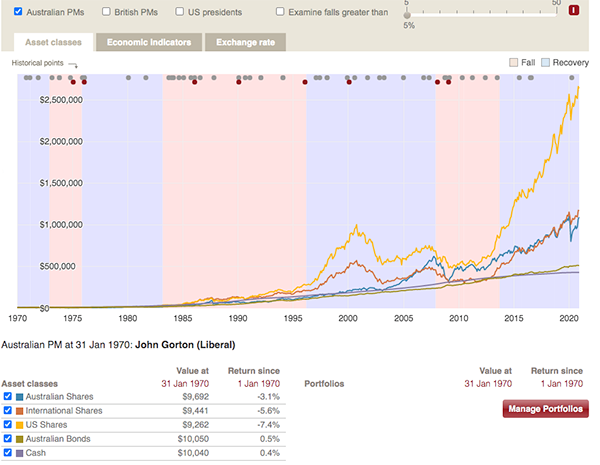

Chart of the Week

This week it’s a chart with a difference! Using this nifty interactive tool from Vanguard you can build your own customised version of the index chart with 30-years of investment performance of major asset classes as well as key economic, social, political and demographic changes. The below overlays Australian PMs to denote ‘falls and recovery’ over the last 30 years.

A guaranteed ‘rabbit hole’ found here.

Financial Adviser Jokes

A bit like Dad jokes, but worse…