Disclaimer

Information provided on this website is general in nature and does not constitute financial advice. Every effort has been made to ensure that the information provided is accurate. Individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial adviser to take into account your particular investment objectives, financial situation and individual needs.

A Finsec View – Robinhood, Bubbles, US Stimulus and Chinese Empires

Issue: Friday 5 February 2021

Welcome 2021

Traumatic events have a habit of etching themselves in our mind. We can remember where we were and what we were doing even if it was from thousands of miles away and we didn’t have anything to do with it personally. For different generations this will mean different things. The GFC, the 9/11 bombings, Princess Diana’s crash, JFK’s assassination and so on but, for all of us 2020 will be one of those events. Everyone has their own experience of how daily life has changed for them, some changes will be temporary and others will endure far beyond the 2020 recession and the path to recovery. Just another reason we feel lucky to be Australian.

As we write this, our first missive for 2021 we can’t but help think that the musings of Peter Drucker (challenging, insightful, and provocative) makes it all seem a little more palatable. The Daily Drucker, published in 2004, is an old friend of FinSecs and was recently re-discovered during a holiday clean-up – Expect to see more from this revered companion this year.

” Every few hundred years there occurs a sharp transformation. We cross a ‘divide’. Within a few short decades, society rearranges itself – its worldview, its basic values, its social and political structure, its arts, its key institutions. Fifty years later, there is a new world. The people born after the transformation cannot even imagine the world in which their grandparents lived and into which their own parents were born. But today’s fundamental changes, these new realities visible thirty years ago, are actually only beginning and just about to have their full impacts.” Excerpt from The Daily Drucker, 1 February Crossing the Divide.

There have been few years we collectively waved goodbye to quite as enthusiastically as 2020. As we enter 2021, the pandemic still casts a long shadow over our lives, but we move forward with optimism and to Drucker’s point an unusually high level of uncertainty.

GameStop to GameOver…

When we wrote about Robinhood and Reddit investors last year, it was not expected that their activities would ramp up to another extreme level. This time, they take responsibility for a brick-and-mortar chain of video game stores whose stock, despite a year of declining sales (it hasn’t earned a profit since 2017), rose by 125% in five days, 300% in a month and 900% in six months. The stock is of course GameStop and on the 26 January, this small company was the most actively-traded stock in the US by value.The stock has been fuelled by a sub- group of revolters; using a chatroom called Wall-Street-Bets on the social media platform Reddit (r/wallstreetbets) and trading on commission-free broker Robinhood. The tribe is portraying itself as a David V Goliath story. According to that narrative, the big guys on Wall Street have been getting rich gambling on the stock market for years. Why should the little guys not get a chance? Mmm… except equity markets are not casinos, which is why GameStop also illustrates what happens when stock prices don’t reflect reality. Shares are now dropping like stones down from their high of US$483 to under US$100. Many small investors who “jumped on the bandwagon” buying at the inflated prices especially those attracted by the extreme price moves and media coverage will be left holding the bag.

Unfortunately, this is not an isolated case. Nor is GameStop the first sign of problems.

In recent days, Reddit users have also driven up the prices of silver and companies such as BlackBerry and movie theatre giant AMC Entertainment.

The share price of Tesla, for example, skyrocketed 720% last year, in large part when investors bought the stock only because it was already rising. If these momentum investing trends continue, it will likely lead to more financial bubbles and crashes that could make it harder for companies to raise capital, posing a threat to already limping economic recoveries. Even if the worst doesn’t happen, large price movements and allegations of price manipulation could hurt public confidence in financial markets.These speculative bubbles are also causing a performance problem for some of our more respected fund managers, whom spend 100s upon 100s of hours scrutinising a company to ensure that if it is to appear in your portfolio, it does so based on fundamental value. To this point, just because the beforementioned Tesla stock has skyrocketed doesn’t make it a bad investment. This is where the fund managers earn their stripes, it is their job to determine if a company is going to be around in 20 years time or not.

Why the speculation and euphoria?

Encouraged by continuing loose monetary policy, individual investors (in this case cashed up-locked down millennials) continue to throw their money at companies bereft of any fundamental value. Many of these new market participants appear to be expecting infinite share price appreciation from many of these companies while making no provision for any commercial setbacks, regulatory changes or the continuing pandemic.

This phenomenon has driven the divergence between ‘value’ and ‘growth’ stocks to levels which have now surpassed the ‘tech boom’ which ended so suddenly 20 years ago and which destroyed so much wealth.

Meanwhile, many well-established, good quality companies continue to languish unappreciated.

Having a long track record of making healthy profits, paying dividends to shareholders and being highly innovative is not necessarily being translated into better share prices. To Drucker’s earlier point, there is a paradigm shift taking place, yet every company in the “new” space is being treated the same way and every company in the “old” space is suffering the same fate. Quality management is about knowing which in each camp will be here for the long haul.

Bubbles are made to pop

Picking the peak of a bubble is of course extremely difficult to do. Famed investor and chronicler of bubbles Jeremy Grantham reminded us recently that “long, slow-burning bull markets can spend many years above fair value and even two, three, or four years far above. These events can easily outlast the patience of most investors. And, when price rises are very rapid, typically toward the end of a bull market, impatience is followed by anxiety and envy”.

This is why it remains so important to maintain perspective and to not get caught up in hype. Good fund managers prioritise protecting clients from losses, not risking ‘other peoples money’ when there is little room for error. As the old adage goes; ‘Only when the tide goes out do you discover who’s been swimming naked’.

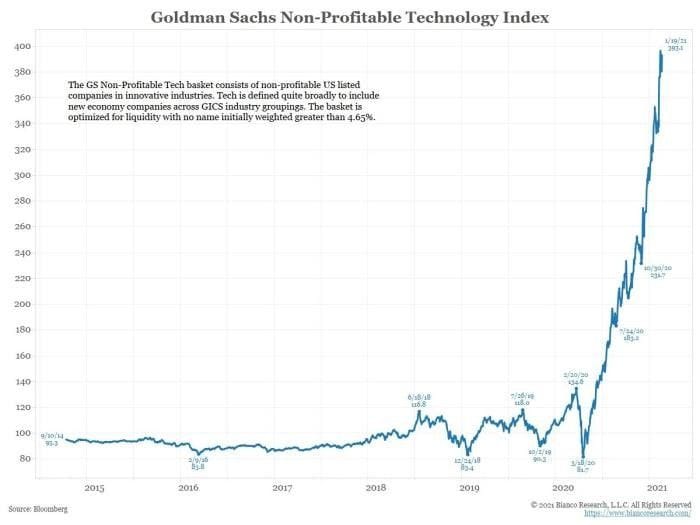

Chart of the Week

Our chart of the week represents the valuations of tech businesses on the US Stock Exchange that don’t make a profit. That’s right companies, that make losses are up 400% in value in the past 12 months.

Biden’s Rescue Plan

In another momentous month in US Politics we saw the storming of the Capitol and the inauguration of Joe Biden on January 20th. Possibly the more enduring however was the result of the US Senate runoff election in Georgia.

This decided which party would hold a Senate majority, in which Republicans have had since 2014. On the verge of maintaining control with a 50-48 advantage the Democrats needed to win both Georgia seats to tie in a 50-50 senate. They did. It was then a matter of Vice President Kamala Harris casting her tie breaking vote, gifting Democrats the chamber majority. This is fundamental in shaping the Biden administration’s direction, of which they are wasting little time in the effort to push the $1.9 trillion economic rescue plan.

The Biden stimulus is admirably ambitious, but it brings with it some big risks too. While markets continue to welcome every announcement, it does raise some obvious questions surrounding the implications on inflation medium term.

In our view Trillions of dollars of fiscal stimulus is desperately needed but, let’s hope its arrival brings better economic data and improved social equality rather than just another sustained bout of share buying. As economic fundamentalists we watch very closely for signs of inflation and wage pressure (inevitable given the amount of stimulus), the implications on interest rates will have diametrically opposed impacts for savers Vs borrowers.

11 Positive Things Nobody Tells You About Ageing

As we go through life, age and approach retirement we tend to measure what we have in monetary terms rather than the wealth we have created through knowledge, wisdom and experiences.

This article is a nice light read that celebrates the acuity of our golden years. Click here to read.

Building an Empire or Coronavirus Probe?

We finish with an interesting opinion piece by Neil Newman (a portfolio strategist focused on pan-Asian equity markets) that appeared in the South China Post late last week. Newman writes about the China-Australia clash but with a very different perspective. He touts the view that perhaps the clash may be more about Beijing’s economic fears than a coronavirus probe.

Is China doing to Australia what the Brits did to China with tea 200 years ago? With iron ore mines in Africa and a port in Papua New Guinea, is China simply falling back on its own ’empire’, displaying frugality (at least in non-yuan transactions) perhaps out of fears its economic strength is nothing more than a post-Covid blip?

A logical synopsis compared to some our mainstream media scaremongering and an interesting read indeed!